Real Estate

Los Angeles County Multifamily Coastal Classic 1928

Annualized return 3

Term 3

7 to 10 Years

Per the amended marketing rules adopted by the SEC, some investment details can only be shown to certain logged-in members.

Status

Almost gone

Remaining

12%

- Tiered pricing available

Learn more about reduced management fees.

Accepting $250,000 - $1,050,000 investments

Please refer to your Activity Feed for the latest update on the property.

Returns & Management fees

Returns & Management fees

Returns & Management fees

Overview

An exceptional investment opportunity supported by a premier multifamily property located in the vibrant area of Long Beach, California. The property at 222 Grand Ave stands as a testament to luxury and modern living, offering investors a unique chance to be part of a lucrative real estate venture in one of California’s most sought-after coastal cities.

Compounded returns: Interest generated by the investment will compound and accrue monthly, maximizing the return potential for investors. We plan on increases rents annually by 50 basis points. This will be translated into higher yield.

Loan-to-cost: Our average Loan to Value for our buildings are 54.3% . We always focus on protecting the asset.

Alignment of interests: The Sponsor has contributed 10% across all buildings.

Premise

Investment details

What am I investing in?

- An investment to facilitate the purchase of a replacement interest rate cap and provide working capital to cover operational expenses at the property.

- The investment is supported by a multi-family property, 2010 West End, in Downtown Nashville, Tennessee. The property is located at 2010 West End Ave, Nashville, TN 37203.

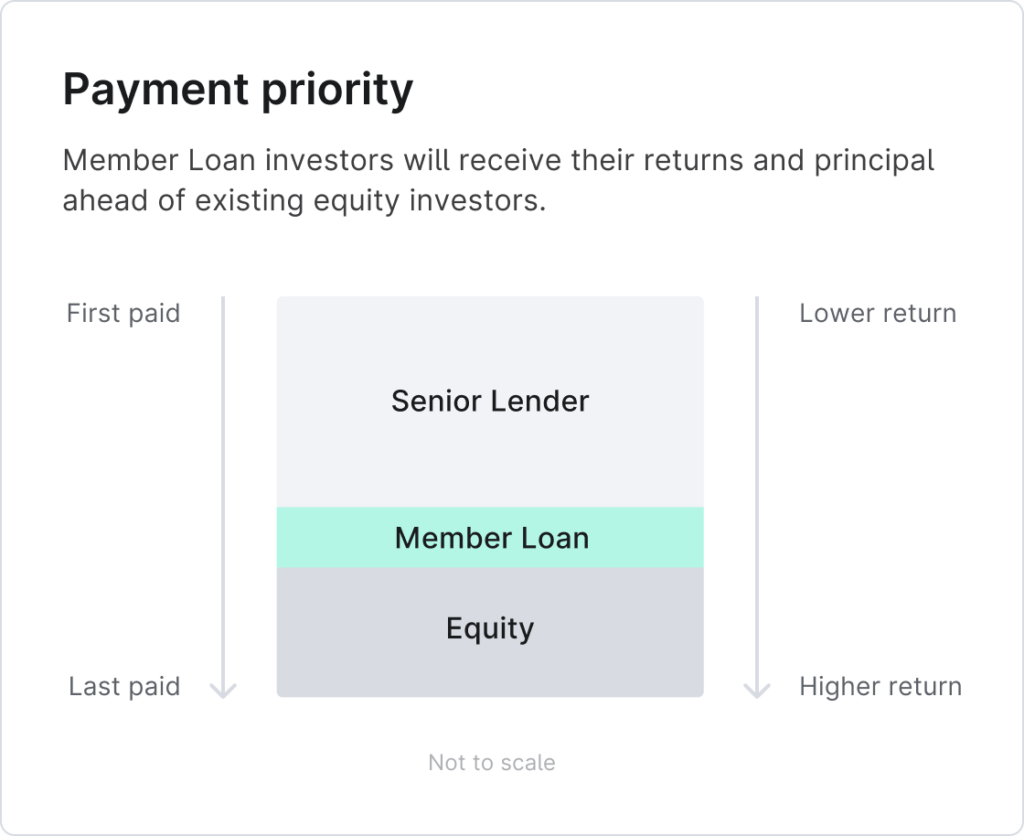

- The investment is senior to common equity but subordinate to the existing senior first mortgage loan, helping to provide investors with more downside protection than traditional equity.

- Interest generated by the investment will compound and accrue on a monthly basis, and be repaid at the time of loan refinance or sale of the property.

- The investment, which has no set maturity date, is expected to be repaid in approximately 24 months (December 2025), concurrently with a sale of the property or a refinancing.

- Yieldstreet has the right but not the obligation to compel a sale of the property after April 2024 to pursue an exit from the investment.

Investment strategy

What is the value proposition?

- The Sponsor purchased the property in December 2021. As of October 31, 2023, the property is 90% occupied and rents for occupied units are ~11% higher than in-place rents at acquisition.

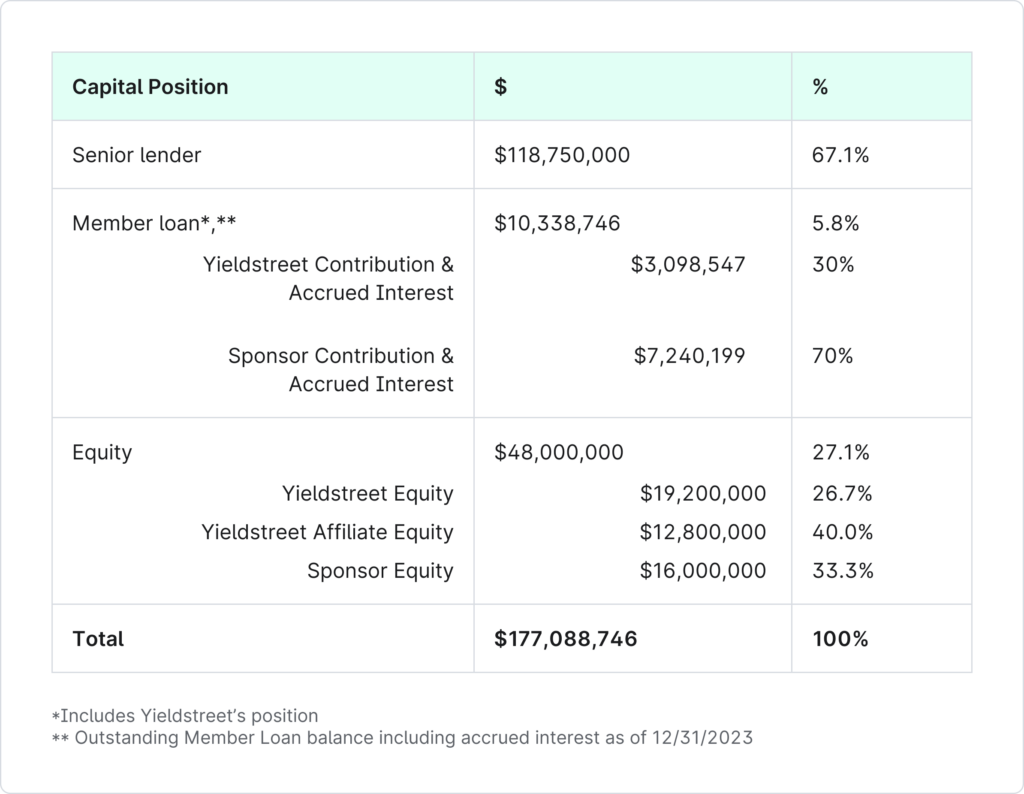

- To finance the acquisition of the property, the sponsor obtained a $118.75M first mortgage loan provided by a global investment and asset management platform with over $100B of AUM. The loan bears an interest rate of SOFR + 3.05%.

- At closing of the first mortgage loan, an interest rate cap with a strike price of 3.00% was purchased to help limit interest rate risk.

- The interest rate cap has been effective given rising rates, and limited the interest rate of the loan to 6.05%. Without it, the rate on the loan would have increased to as high as 8.5%+.

- The interest rate cap expires in January 2024, and the senior lender has required that the sponsor buy another rate cap to continue limiting interest rate risk moving forward.

- The proceeds of the investment, along with the sponsor’s contributions, will be used to cover the cost of the interest rate cap and provide working capital for operating shortfalls.

- We anticipate a sale of the property within the next two years, at which time the investment is expected to be repaid. As such, there is no stated maturity associated with the investment.

Behind the investment

Who is the sponsor?

- Founded in 2022, Flow is a residential real estate company that is backed by Andreessen Horowitz, the largest venture capital firm in the U.S. Flow is a full-service real estate owner and operator that seeks to address the housing shortage in the nation. The Sponsor acquires and oversees multifamily properties across the US. Currently, the Sponsor has a portfolio of over 3,000 multifamily units in major markets such as Nashville, Atlanta, Miami, Fort Lauderdale, amongst others.

- At acquisition, the sponsor contributed $9.6M of equity to the investment. In March 2023, the sponsor purchased $6.4M of equity from YS SPV, which brought their total equity contribution to $16M. In addition, Flow has contributed $6.4M of additional capital in the form of a loan to support the investment over the past 18 months.

- Given the amount of capital that the sponsor has invested, their interests are aligned with Yieldstreet investors, incentivizing them to effectively and efficiently manage the property to optimize investor returns.

Market backdrop

The state of the CRE market

- The commercial real estate investment landscape has fundamentally shifted from a period of abundant capital and double-digit rent growth to a period of restrictive capital, stagnating rent growth and materially higher interest rates.

- The lack of clarity on where things are headed has effectively frozen the commercial real estate market as transaction volume remains depressed and access to capital, whether in the form of debt or equity, is difficult to secure.

- The investment provides an opportunity for investors to enter into a transaction at a materially lower leverage level, with over $48M of subordinate equity, while earning equity-like returns.

Essentials

Please refer to the investment memorandum and the operating agreement for more information.

Capital structure

Where does Yieldstreet lie in terms of priority?

- The investment is senior to the common equity but subordinate to the senior loan and previous member loans extended by the Sponsor.

- The senior loan was provided by a global investment management and asset management platform with over $100B of AUM.

- Across Nashville Multi-Family Equity II.A, Yieldstreet investors contributed $32M of the common equity.

- $16M of the remaining equity was provided by the sponsor.

Cash flow

How do I get paid?

- Interest generated by the member loan is expected to compound and accrue on a monthly basis at the stated target net annualized yield. Interest and principal owed to investors is expected to be repaid at loan repayment which is expected by December 2025.

- At the time of loan repayment, Yieldstreet’s management fees and other expenses as further described in the series note supplement are deducted first.

- Next, the remaining proceeds are paid to investors up to the target net annualized yield.

- Please note, only once all expense amounts set forth in the Investment Memorandum have been paid in full, will payments begin reflecting in investor wallets.

- Please refer to the Investment Memorandum for additional details regarding the offerings prioritization of distributable proceeds.

Accessibility

Who can invest?

- This offering is available to accredited investors. Please refer to the Investment Memorandum for more information.

- This offering is not available to retirement accounts.

Subscription process

When will my investment be made active?

- The Fund will conduct monthly internal closings on the last day of each month, beginning Feb 19, 2023.

- Investment requests will remain pending until internal closes.

- Investors must be ready to invest with sufficient funds available in order to be included in an internal close.

Post investment

What to expect after you invest in the fund?

- Quarterly investment updates as of year end prepared by Platinum LLC accounting.

- Investors should expect to receive a K-1 tax document for this investment. K-1s will be made available between March and September of the following tax year.

Returns & Management fees

Ann’l management fee

Target ann’l net return

Returns & Management fees

Ann’l management fee

Target ann’l net return

Returns & Management fees

Ann’l management fee

Target ann’l net return

Target yields are offered as opinion and are not referenced to past performance. Target yields are not guaranteed and results may differ materially.

Investing in private markets and alternatives, such as this offering, is speculative and involves a risk of loss, and those investors who cannot afford to lose their entire investment should not invest. Returns are not guaranteed.

“Annual interest,” “Annualized Return” or “Target Returns” represents a projected annual target rate of interest or annualized target return, and not returns or interest actually obtained by fund investors. Unless otherwise specified on the fund’s offering page, target interest or returns are based on an analysis performed by Yieldstreet of the potential inflows and outflows related to the transactions in which the strategy or fund has engaged and/or is anticipated to engage in over the estimated term of the fund. There is no guarantee that targeted interest or returns will be realized or achieved or that an investment will be successful. Actual performance may deviate from these expectations materially, including due to market or economic factors, portfolio management decisions, modelling error, or other reasons.